Houston Real Estate Market Update April 14th

Houston Listings Surge While Closings Slow Amid Rising Rates

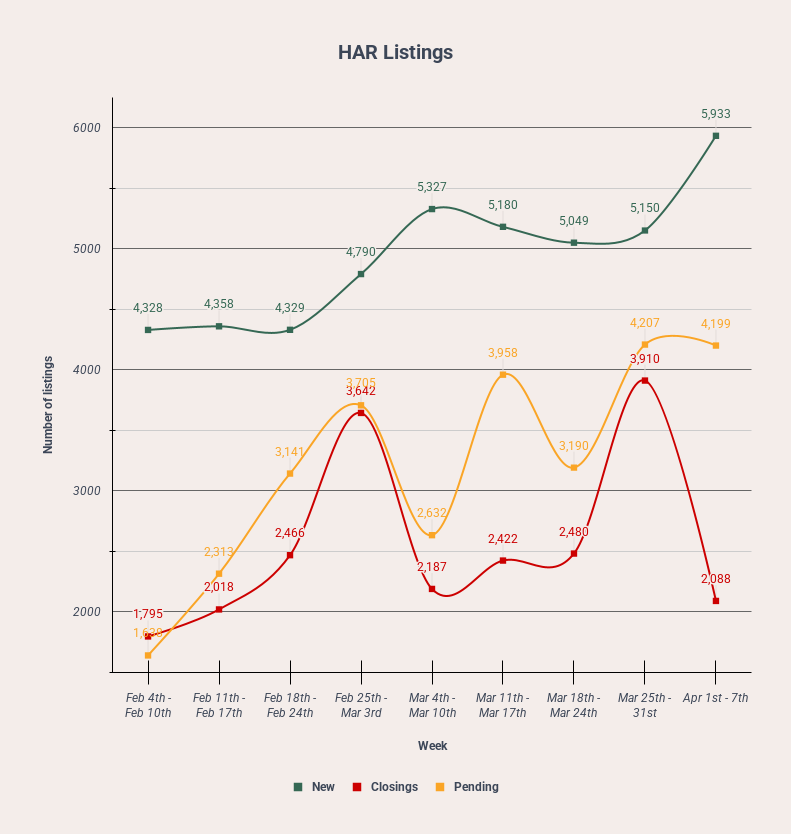

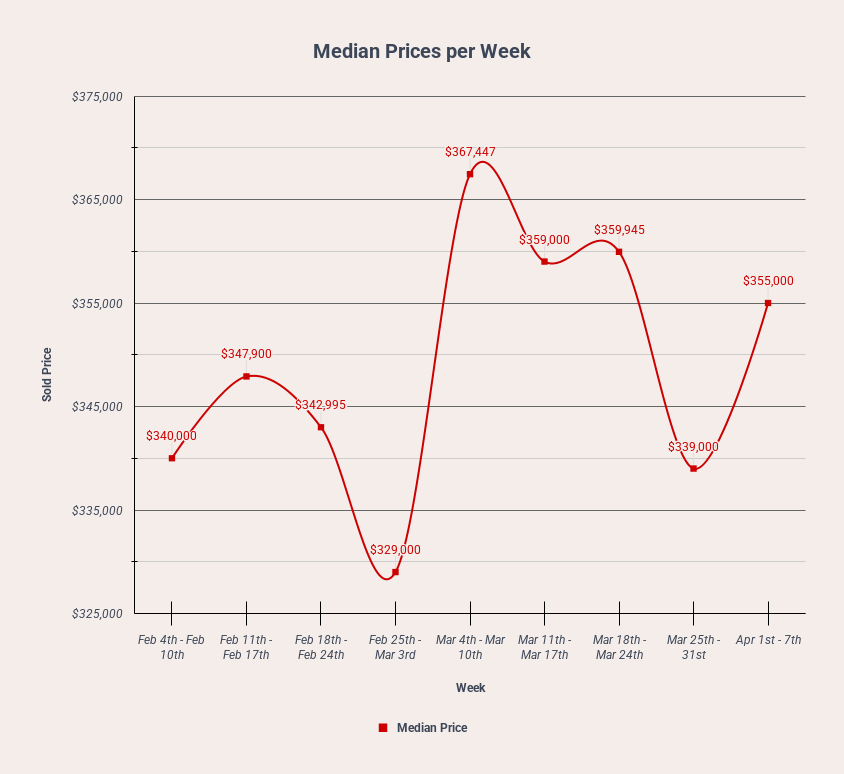

HOUSTON, TX – April 14, 2025 – The Houston real estate market entered April with a strong influx of new inventory, as new listings jumped 15.20% during the week of April 1–April 7, 2025. Despite the increase in homes available, closings dropped significantly (-46.60%), and mortgage rates rose to 6.93%, the highest level in several weeks. Meanwhile, the median sold price climbed to $355,000, suggesting continued seller confidence even as some buyers hesitate in response to rate pressure.

Market Highlights

-

New Listings: 5,933 homes hit the market, a 15.20% increase from the previous week.

-

Pending Sales: 4,199 homes went under contract, holding steady with a slight 0.19% decrease.

-

Closings: 2,088 homes sold, reflecting a 46.60% decline, likely due to rate-driven delays.

-

Median Sold Price: $355,000, an increase of 4.72%, marking strong seller positioning.

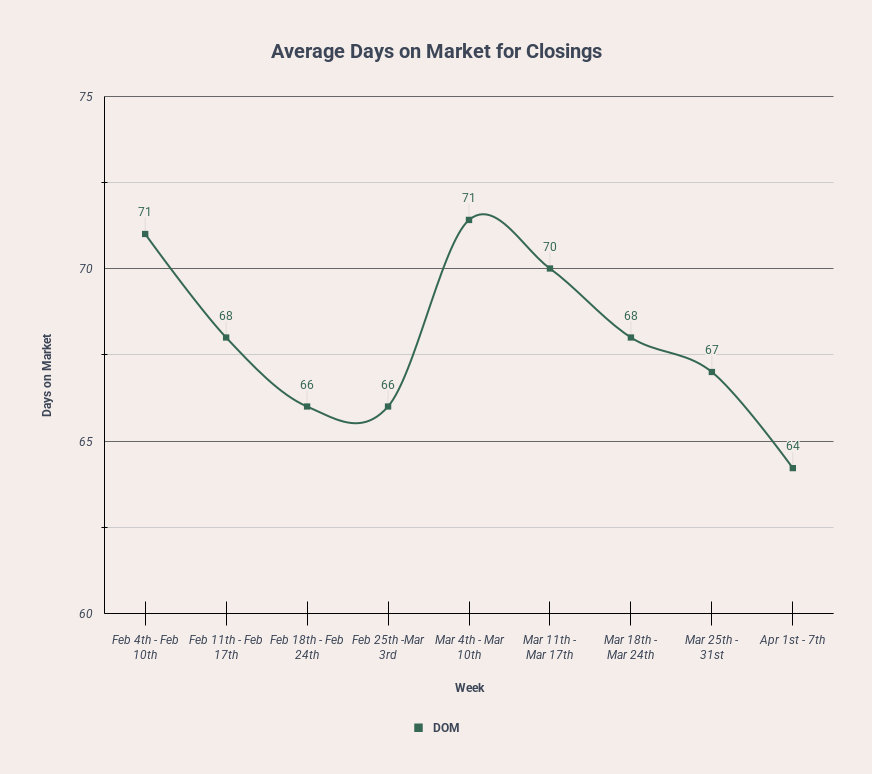

- Days on Market (DOM): 64 days, down 4.16%, suggesting quicker transactions for well-priced homes.

-

30-Year Mortgage Rate: 6.93%, a 2.51% increase from the previous week.

Single-Family Home Market Performance

Houston’s spring market continues to shift. New listings surged to 5,933 this week, offering buyers a wide range of options. Despite this, closings fell drastically, which may reflect buyers delaying deals due to the sharp rise in interest rates.

Still, pending sales held nearly flat, suggesting that interest remains strong, even if some transactions are taking longer to finalize. The median price increased to $355,000, showing that competitive homes are maintaining value, while days on market dropped to 64 days, indicating some listings are still moving quickly when priced right.

Mortgage Rates and Market Implications

The 30-year fixed mortgage rate climbed to 6.93%, up 2.51% from last week—one of the largest week-over-week jumps this year. This rate pressure may have contributed to the steep drop in closings, as affordability and buyer qualifications are affected. However, buyers who are prepared and pre-approved still have opportunities, especially with more homes coming online.

Alaina’s Pro Tip of the Week

With new listings up over 15% and mortgage rates climbing to 6.93%, buyers should act quickly before affordability tightens further. A higher median price reflects market confidence, but a sharp drop in closings may signal hesitancy. Sellers should take advantage of strong pricing power but be mindful of rising rates that could limit buyer reach.

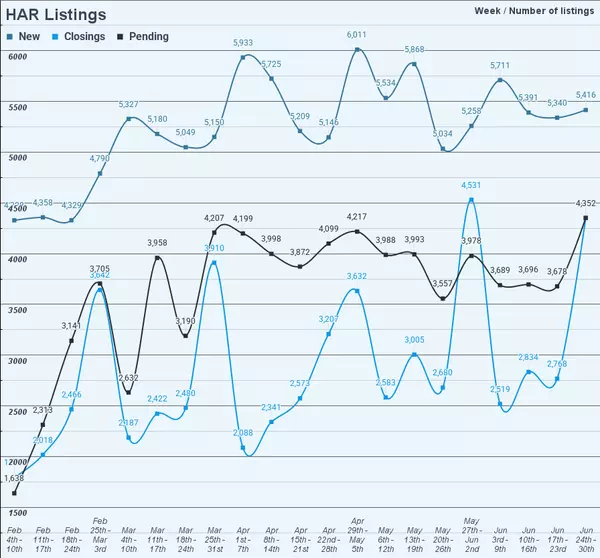

Market Outlook

Houston’s market is showing signs of rebalancing. While inventory is expanding, rising rates could temporarily slow buyer activity. If rates stabilize, we may see a rebound in closings in the coming weeks. Buyers who act now may benefit from a wider selection and less competition. Sellers should stay flexible and be prepared to respond to changing demand.

Looking Ahead

As spring progresses, Houston’s housing market will likely remain active but sensitive to interest rate fluctuations. Staying informed will be key to making confident decisions in this dynamic environment.

📲 For expert insights and personalized guidance, contact Alaina Segovia today.

📞 (832) 921-0506 | 🌐 https://www.alainasegovia.com

✨ Stay tuned for next week’s update, and follow for the latest in Houston real estate!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "